Solutions for Advisors of all sizes

Whether you are a veteran Registered Investment Advisor or an experienced trader thinking of becoming an RIA, Best Mastery Capital can help you achieve your goals.

-

Compliance Center

Read More

Compliance Center

Read More

-

Automated Client Management

Read More

Automated Client Management

Read More

-

Advisor Webinars

Read More

Advisor Webinars

Read More

-

Securities Financing

Read More

Securities Financing

Read More

-

Lower Costs

Read More

Lower Costs

Read More

-

Global Markets

Read More

Global Markets

Read More

-

Innovative Technology

Read More

Innovative Technology

Read More

-

Investors Marketplace

Read More

Investors Marketplace

Read More

-

Financial Strength

Read More

Financial Strength

Read More

-

Comprehensive Reporting

Read More

Comprehensive Reporting

Read More

-

Additional Resources

Read More

Additional Resources

Read More

-

Open An Account

Read More

Open An Account

Read More

BMC's RIA Compliance Center

Basic information on the registration and compliance requirements facing investment advisors that includes a webinar on

RIA compliance and PDF documents that spotlight major compliance topics.

Automated Client Billing and Management

Enjoy the Freedom and flexibility to run your own business with no contract and minimal start-up and overhead costs.

Automated Client Billing

- Enter client fees during client registration or anytime in AccountManagement.

- Assign client fees to accounts individually or store them in client fee templates and apply them to multiple clients at a time.

- Flexible client fee options include the ability to charge client commissions to your own Advisor master account, charge fees on client investments in hedge funds at our Hedge Fund Investor Site (available at the Investors' Marketplace), and even reimburse fees to client accounts.

Electronic Invoicing

- Automated electronic invoicing lets you submit client fee invoices in Account Management.

- Set maximum invoicing amounts or percentage caps.

- Meet your compliance obligations by notifying your clients of advisory fee details.

Client Management

- Dashboard

- CRM

- >White branding

We make it easy to manage

your clients:

Client Applications and Transition

- Fully- and semi-electronic applications

- Application XML

- Mass upload

- White-branded applications

We offer a variety of options for adding clients and migrating to our platform:

Advisor Webinars

Securities Financing

Our depth of availability, transparent and competitive loan and borrow rates, automated tools and dedicated service representatives

give you the advantages you expect from Best Mastery Capital.

Depth of Availability

The combination of both internal supply and external relationships allows us to offer our clients a vast array of securities to trade:

- Our large and diverse customer base lets us source internally approximately 60 to 70% of our short borrow needs.

- BMC has securities lending/borrowing relationships with more than 60 counterparties, comprised of Agent Lenders, banks and broker dealers in the U.S.

- Our team provides consistent high levels of protection against recalls and buy-ins on hard to borrow securities, creating extended time horizons for even the most difficult short selling strategies.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Lower Your Costs to Maximize Your Return

Our transparent, low commissions and financing rates, and best price executions minimize your costs to help you maximize your returns.

Generate Higher Returns

Lower commissions, no ticket charges; no minimums; and no technology, software, platform, or reporting fees. Low financing rates, and higher loan values on portfolio margin accounts over $100K.

Best Price Execution

Most brokers trade against your orders or sell them to others to execute who will trade against them. The resulting poor execution probably costs you more than the commission you pay. BMC SmartRoutingSM continuously searches and reroutes to the best available prices for stocks, options and combinations.

| Execution Price Improvement Comparison* | |||

|---|---|---|---|

| US Stocks (per 100 shares) |

US Options (per contract) |

European Stocks (per 100 shares) |

|

| Best Mastery Capital | $0.38 | $0.84 | €0.08 |

| Industry | $0.32 | $0.60 | - €0.84 |

| BMC Advantage | $0.06 | $0.24 | €0.93 |

Net Dollar Price Improvement vs. National Best Bid/Offer 1

**Based on independent measurements, the Transaction Auditing Group, Inc., (TAG), a third-party provider of transaction analysis, has determined that Best Mastery Capital' US stock and options price executions were significantly better than the industry's during the second half of 2016. 2

- Net $ Improvement per Share Definition:

((# of Price Improved Shares * Price Improvement Amount) - (# of Price Disimproved Shares * Price Disimprovement Amount)) / Total Number of Executed Shares - The Transaction Auditing Group (TAG). Industry as a whole for the referenced periods according to TAG. The TAG analysis for US stocks included all market orders of 100 shares or more up to 10,000 shares. The analysis for US options included all market order sizes in US options and includes exchange rebates received by clients under BMC's cost-plus pricing structure. The TAG analysis of orders routed to exchanges in Europe included all orders routed for execution during regular trading hours including all market and marketable limit orders and orders near the market (orders having a limit price within one-tenth of a Euro from the quote price at time of order receipt) on stocks listed on the included exchanges, weighted by the volume executed on each exchange. The exchanges for European stocks are XETRA, EURONEXT, CHI-X, WIENER BORSE, TURQUOISE, LONDON and NASDAQ OMX.

Your Gateway to the World's Markets

Direct market access to stocks, options, futures, forex, bonds,

ETFs and CFDs from a single BMC Universal Account™.

100

Markets

24

Countries

22

Currencies

Access market data 24 hours a day and six days a week to stay

connected to all global markets.

Convert currencies at market determined rates as low as 1/10 of a basis point, or create a position collateralized by a non-native currency.

Fund your account in multiple currencies. Trade assets denominated in multiple currencies from a single account.

Learn MoreInnovative Technology

We've been building online trading

technology that provides competitive pricing, speed,

size, diversity of global products, advanced trading tools to our clients for 40 years.

Trading Platforms

Our online trading platforms have been designed with the professional trader in mind:

- Optimize your online trading speed and efficiency with our market maker-designed Trader Workstation (TWS).

- Trade your BMC account on-the-go from just about any mobile device with BMC TWS.

- Use our HTML-based WebTrader, a clean and simple interface that works from behind a firewall.

Advanced Trading Tools

Our suite of Option Labs and advanced online trading tools offer support to help you discover and implement optimal trading strategies. For example, our Probability Lab offers a practical way to think about options without the complicated mathematics, and the Option Strategy Lab lets you create simple and complex multi-leg option orders based on your own price and volatility forecast.

Learn MoreOrder Types and Algos

Trader Workstation (TWS) supports over 60 order types, from the most basic limit order to advanced trading to the most complex algorithmic trading, to help you execute a wide variety of trading strategies.

Learn MoreSophisticated Risk Management

Real-time market-risk management and real-time monitoring provide a comprehensive measure of risk exposure across multiple asset classes around the globe and real-time data that gives you the edge you need to react quickly to the markets.

Learn MoreComprehensive Reporting

Our statements and reports include real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and a variety of other supplemental reports.

Learn MoreSecurities Financing

From trade date to settlement date, our Securities Financing solutions provide depth of availability, transparent rates, global reach and automated lending and borrowing tools to professional traders.

Learn MoreInvestors' Marketplace

Investors and clients can meet and interact with third-party service providers to connect and conduct business.

495

investment

services

95

research

services

295

technology

services

45

administrative

services

300

business development

services

- Individual traders and investors, financial advisors, fund managers and third-party service providers can meet and do business together.

- Search the marketplace and connect to a variety of service providers, including advisors, hedge funds, research analysts, business developers and administrators.

- Advertise your own third-party services to individual and institutional users worldwide.

- Free to advertise and search, the Investors' Marketplace is

Financial Strength and Stability

Our strong capital position, conservative balance sheet and automated risk controls protect BMC and our clients from large trading losses.

Best Mastery Capital Group (IBG LLC) equity capital exceeds $6 billion1. 16.6% of IBG LLC is owned by the publicly traded company, Best Mastery Capital Group, Inc. and the remaining 83.4% is owned by our employees and affiliates.

Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively. We hold no material positions in OTC securities or derivatives. We hold no CDOs, MBS or CDS. The gross amount of our portfolio of debt securities, with the exception of US governments debt securities, is less than 10% of our equity capital.%。

- Includes Best Mastery Capital Group and its affiliates.

Comprehensive Reporting

Easy to view and customize, our statements and reports cover all aspects of your Best Mastery Capital account.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Additional Resources

Enjoy the freedom and flexibility to run your own business with no contract, minimal start up and overhead costs,

and the ability to keep 100% of your fees.

BMC Customer Sites

BMC Customer Sites provides a complimentary web site with custom graphic design and content. We will work with you to create a customized, professional business web site.

White Branding

White brand statements, customer registration and other informational materials with your own organization's identity, including performance reports created by our Portfolio Analyst.

Customer Relationship Management (CRM)

Our Customer Relationship Management (CRM) system lets you manage your entire customer relationship life cycle in one place at no cost.

Trading Desks

BMC provides broker-assisted trading through our Stock, Option or Bond desks.

Pre-Trade Allocations

Pre-Trade Allocations define a variety of criteria to automatically allocate shares to a single client account or multiple client accounts with a single mouse click.

Model Portfolios

Build Model Portfolios and allocate client funds among the different models based on your clients' individual needs.

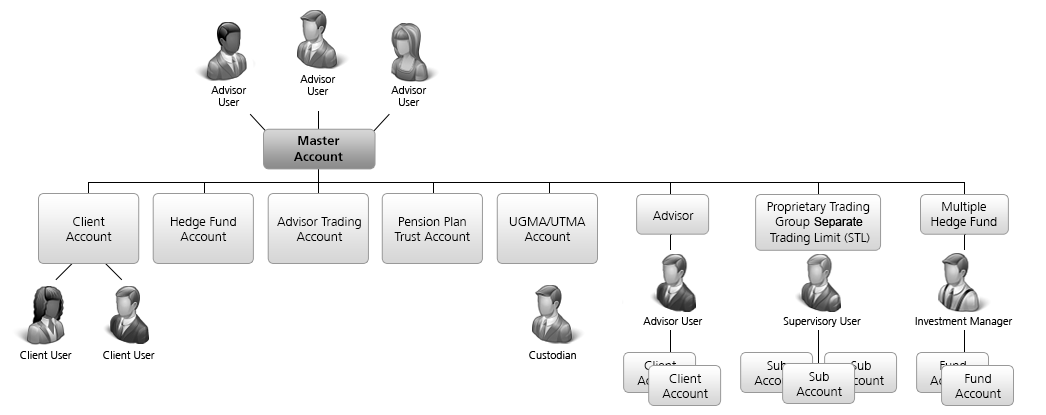

Open an Account

Our Advisor accounts let Professional Registered Investment Advisors (RIAs) and Commodity Trading Advisors (CTAs)

execute and allocate trades among multiple clients from a single order management interface.

Account Information

Advisors who manage client accounts in excess of state registration minimums (generally 16 or more accounts and US $25 million in assets) must be registered under local regulatory law (e.g. Registered Investment Advisors (RIA) for US securities and Commodity Trading Advisors (CTA) for US commodities).

The account can be white branded with the advisor's corporate identity.

Advisor master account holders must be 21 or older.

Professional Registered Investment Advisors can create multiple tier accounts by adding Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master accounts to their account structure. Each Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master account on the second tier can add client/sub/hedge fund accounts as required. Individual and Joint account holders under an Advisor account structure can add authorized traders to become STL accounts.

Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries that are prohibited by the US Office of Foreign Assets Control. Click here for a list of available countries.

Documentation

Advisor Getting Started PDF Guide How to Become an RIA PDF Guide Advisors/Brokers Application Guide

Advisor Account Structure

An individual or organization Registered Advisor whose master account is linked to multiple individual or organization client accounts.

- The master account is used for fee collection and trade allocations.

- The advisor can open a single account for his or her own trading.

For information on SIPC coverage on your account, visit www.sipc.org or call SIPC at 1 (202) 371-8300.