Best Mastery Capital Makes It Easy to Manage Your Group

Our Friends and Family Group Accounts provide easy management, trading and reporting for multiple accounts under a single login, or provide a first step for advisors whose RIA registrations are pending or who aspire to become RIAs

-

Lower Costs

Read More

Lower Costs

Read More

-

Global Markets

Read More

Global Markets

Read More

-

Innovative Technology

Read More

Innovative Technology

Read More

-

Financial Strength

Read More

Financial Strength

Read More

-

Open An Account

Read More

Open An Account

Read More

Lower Your Costs to Maximize Your Return

Our transparent, low commissions and financing rates, and best price executions

minimize your costs to help you maximize your returns.

Generate Higher

Returns

We offer lower commissions, no ticket charges; no minimums; no technology, software, platform, or reporting fees; and low financing rates, with higher loan values on portfolio margin accounts over $100K. Click below to see how our low costs compare to other brokers.

Learn MoreBest Price

Execution

Most brokers trade against your orders or sell them to others to execute who will trade against them. The resulting poor execution probably costs you more than the commission you pay. BMC SmartRouting SM continuously searches and reroutes to the best available prices for stocks, options and combinations.

Learn MoreLowest Margin

Rates

We offer the lowest margin loan interest rates of any broker, according to the Barron's 2017 online broker review. Click below to calculate your own sample margin loan interest rate.

Learn MoreStock Yield

Enhancement Program

Earn income on your fully-paid stock shares in our Stock Yield Enhancement Program. The program lets us borrow your shares in exchange for cash collateral, and then lend the shares to traders who are willing to pay a fee to borrow them. You will be paid a loan fee each day that your stock in on loan.

Learn MoreYour Gateway to the World's Markets

Direct market access to stocks, options, futures, forex, bonds,

ETFs and CFDs from a single BMC Universal Account™.

100

Markets

24

Countries

22

Currencies

Access market data 24 hours a day and six days a week to stay

connected to all global markets.

Convert currencies at market determined rates as low as 1/10 of a basis point, or create a position collateralized by a non-native currency.

Fund your account in multiple currencies. Trade assets denominated in multiple currencies from a single account.

Learn MoreInnovative Technology

We've been building online trading

technology that provides competitive pricing, speed,

size, diversity of global products, advanced trading tools to our clients for 40 years. Year after year, our robust technology supports record numbers of Daily Average Revenue Trades (DARTs).4

Trading Platforms

Our online trading platforms have been designed with the professional trader in mind:

- Optimize your online trading speed and efficiency with our market maker-designed Trader Workstation (TWS).

- Trade your BMC account on-the-go from just about any mobile device with BMC TWS.

- Use our HTML-based WebTrader, a clean and simple interface that works from behind a firewall.

Advanced Trading Tools

Our suite of Option Labs and advanced online trading tools offer support to help you discover and implement optimal trading strategies. For example, our Probability Lab offers a practical way to think about options without the complicated mathematics, and the Option Strategy Lab lets you create simple and complex multi-leg option orders based on your own price and volatility forecast.

Learn MoreOrder Types and Algos

Trader Workstation (TWS) supports over 60 order types, from the most basic limit order to advanced trading to the most complex algorithmic trading, to help you execute a wide variety of trading strategies.

Learn MoreSophisticated Risk Management

Real-time market-risk management and real-time monitoring provide a comprehensive measure of risk exposure across multiple asset classes around the globe and real-time data that gives you the edge you need to react quickly to the markets.

Learn MoreComprehensive Reporting

Our statements and reports include real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and a variety of other supplemental reports.

Learn MoreSecurities Financing

From trade date to settlement date, our Securities Financing solutions provide depth of availability, transparent rates, global reach and automated lending and borrowing tools to professional traders.

Learn MoreFinancial Strength and Stability

Our strong capital position, conservative balance sheet and automated risk controls protect BMC and our clients from large trading losses.

Best Mastery Capital Group (IBG LLC) equity capital exceeds $6 billion1. 16.6% of IBG LLC is owned by the publicly traded company, Best Mastery Capital Group, Inc. and the remaining 83.4% is owned by our employees and affiliates.

Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively. We hold no material positions in OTC securities or derivatives. We hold no CDOs, MBS or CDS. The gross amount of our portfolio of debt securities, with the exception of US governments debt securities, is less than 10% of our equity capital.%。

- Includes Best Mastery Capital Group and its affiliates.

Open an Account

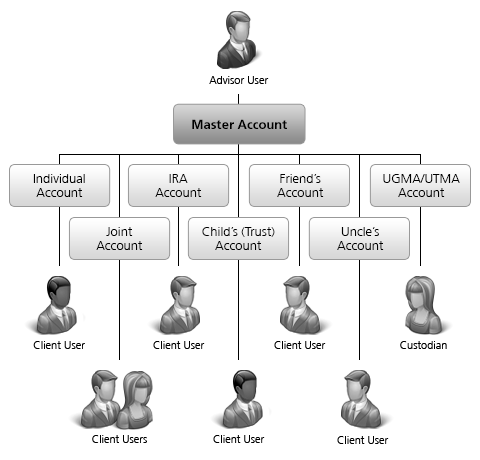

Manage 15 or fewer multiple accounts of varying types under a single login, including Individual, Joint, Trust, IRA, UGMA/UTMA, Corporation, Partnership, Limited Liability Corporation, and Unincorporated Legal Structures.

Friends and Family Account Structure

A master account linked to individual client accounts.

- The master account is used for fee collection and trade allocations.

- The advisor can open a single client account for his or her own trading.

Account Information

Only Advisors who are exempt from registration are eligible to open a Friends & Family account. Generally, most jurisdictions require that an advisor have 15 or fewer clients in order to qualify for exemption from registration. However, registration requirements can vary among jurisdictions. For example, advisors residing in the U.S. may be required to register under either State or Federal law if they meet certain criteria (e.g., total assets under management, number of clients, whether they receive compensation, etc.).

Advisors whose Registered Independent Advisor registrations are pending or who aspire to become RIAs can open a Friends and Family Group account and then, when their registration is complete, can upgrade their account to a Registered Investment Advisor account by entering information about their securities and/or commodities registration on the Advisor Qualifications page in Account Management.

Must be 21 or older to open a margin account, 18 or older to open a cash account.

Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries that are prohibited by the US Office of Foreign Assets Control. Click herefor a list of available countries.

A UGMA/UTMA account is intended for a custodian of a minor who is a US resident, and is available as a Cash account only. Minimum deposit is 3000 USD or non-USD equivalent and the monthly activity fee for age 25 or younger applies. A UGMA/UTMA account is a single account with a default single user (the custodian), and up to five Power of Attorney users can be added. The minor for whom the account is opened must be a US legal resident and a US citizen.

For information on SIPC coverage on your account, visit www.sipc.orgor call SIPC at 1 (202) 371-8300.