Complete Turnkey Solution for Money Managers

Trade multiple client accounts across multiple Wealth Managers

-

Securities Financing

Read More

Securities Financing

Read More

-

Global Markets

Read More

Global Markets

Read More

-

Innovative Technology

Read More

Innovative Technology

Read More

-

Investors' Marketplace

Read More

Investors' Marketplace

Read More

-

Comprehensive Reporting

Read More

Comprehensive Reporting

Read More

-

Open An Account

Read More

Open An Account

Read More

Securities Financing

Our depth of availability, transparent and competitive loan and borrow rates, automated tools and dedicated service representatives

Depth of Availability

The combination of both internal supply and external relationships allows us to offer our clients a vast array of securities to trade:

- Our large and diverse customer base lets us source internally approximately 60 to 70% of our short borrow needs.

- BMC has securities lending/borrowing relationships with more than 60 counterparties, comprised of Agent Lenders, banks and broker dealers in the U.S.

- Our team provides consistent high levels of protection against recalls and buy-ins on hard to borrow securities, creating extended time horizons for even the most difficult short selling strategies.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Transparent, Competitive Loan and Borrow Rates

- We disclose our short stock availability (aka "locates") to ALL customers on a first come, first serve basis for every supported security on our trading platform, Trader Workstation (TWS).

- We disclose indicative rebate rate and fee rate information, which you can use as an indication of borrow costs.

- Each day, we provide our clients with detailed reports, outlining exactly what the financing costs are for each SLB-related transaction.

Your Gateway to the World's Markets

Direct market access to stocks, options, futures, forex, bonds,

ETFs and CFDs from a single BMC Universal Account™.

100

Markets

24

Countries

22

Currencies

Access market data 24 hours a day and six days a week to stay

connected to all global markets.

Convert currencies at market determined rates as low as 1/10 of a basis point, or create a position collateralized by a non-native currency.

Fund your account in multiple currencies. Trade assets denominated in multiple currencies from a single account.

Learn MoreInnovative Technology

We've been building online trading

technology that provides competitive pricing, speed,

that provides competitive pricing, speed, size, diversity of global products and advanced trading tools to our clients for 40 years.

Trading Platforms

Our online trading platforms have been designed with the professional trader in mind:

- Optimize your online trading speed and efficiency with our market maker-designed Trader Workstation (TWS).

- Trade your BMC account on-the-go from just about any mobile device with BMC TWS.

- Use our HTML-based WebTrader, a clean and simple interface that works from behind a firewall.

Advanced Trading Tools

Our suite of Option Labs and advanced online trading tools offer support to help you discover and implement optimal trading strategies. For example, our Probability Lab offers a practical way to think about options without the complicated mathematics, and the Option Strategy Lab lets you create simple and complex multi-leg option orders based on your own price and volatility forecast.

Learn MoreOrder Types and Algos

Trader Workstation (TWS) supports over 60 order types, from the most basic limit order to advanced trading to the most complex algorithmic trading, to help you execute a wide variety of trading strategies.

Learn MoreSophisticated Risk Management

Real-time market-risk management and real-time monitoring provide a comprehensive measure of risk exposure across multiple asset classes around the globe and real-time data that gives you the edge you need to react quickly to the markets.

Learn MoreComprehensive Reporting

Our statements and reports include real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and a variety of other supplemental reports.

Learn MoreSecurities Financing

From trade date to settlement date, our Securities Financing solutions provide depth of availability, transparent rates, global reach and automated lending and borrowing tools to professional traders.

Learn MoreInvestors' Marketplace

Investors and clients can meet and interact with third-party service providers to connect and conduct business.

495

investment

services

95

research

services

295

technology

services

45

administrative

services

300

business development

services

- Individual traders and investors, financial advisors, fund managers and third-party service providers can meet and do business together.

- Search the marketplace and connect to a variety of service providers, including advisors, hedge funds, research analysts, business developers and administrators.

- Advertise your own third-party services to individual and institutional users worldwide.

- Free to advertise and search, the Investors' Marketplace is

Comprehensive Reporting

Easy to view and customize, our statements and reports cover all aspects of your Best Mastery Capital account.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Tax Optimizer

Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Open an Account

Account Information

An individual or organization Registered Advisor that is hired on behalf of another advisor (Wealth Manager) to manage some or all of their clients money.

Money Managers do not add client accounts, fund client accounts, set client fees or set client trading permissions. Only the Wealth Manager (Financial Advisor) can perform these tasks.

Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries that are prohibited by the US Office of Foreign Assets Control. Click here for a list of available countries.

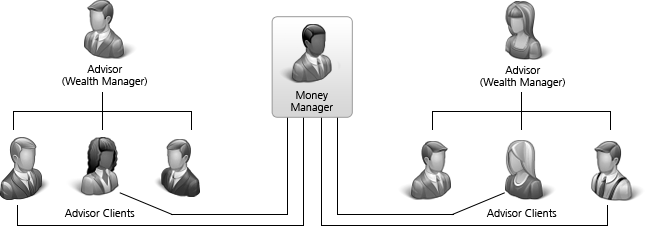

Money Manager Account Structure

Professional Advisors often function as Wealth Managers, responsible for the gathering of customer assets while assigning separate Money Managers to execute and allocate trades among their multiple clients. Money Manager Accounts allow these designated traders to register as Money Managers and accept client trading assignments from Professional Advisors, then trade for multiple clients from a single order management interface.

Money Manager Structure Chart

For information on SIPC coverage on your account, visit www.sipc.org or call SIPC at 1 (202) 371-8300.