Our depth of availability, transparent rates, global reach, dedicated service representatives and automated lending and borrowing tools give you the advantages you expect from Best Mastery Capital.

Overview

Availability

On trade date, it's all about availability. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls.

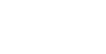

BMC gives clients two ways to view available shares for shorting in real time:

- Clients can view the number of shares that are available to short, as well as the current interest rate charged on borrowed shares and the current Fed Funds rate in Trader Workstation by adding the Shortable Shares, Fee Rate and Rebate Rate columns.

- Clients can search for real-time availability of shortable stocks themselves using our fully electronic, self-service Short Stock Availability Tool. They can also choose to be notified when a borrow becomes available in shares that they were unable to short in the last week.

Transparent Rates

Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Our stock loan and borrow rates are very competitive. We use the best market data available to measure ourselves. We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools.

We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace.

Global Reach

At Best Mastery Capital, global reach starts with our breadth of product offering and extends to our securities financing services. Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. In the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers.

Our global reach doesn't stop there. We maintain dedicated, professionally-staffed SLB desks in the United States, Europe and Asia who are ready to help you with all of your securities financing needs, including stock loan and borrow questions.

Automated Tools

BMC has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. We offer a variety of stock loan and borrow tools:

- Stock Yield Enhancement Program - Earn income on the fully-paid shares of stock held in your account.

- Short Stock Availability – Search for real-time availability of shortable stocks with our fully electronic, self-service utility tool.

- Yield Optimizer - Compare borrow rates on hard-to-borrow stocks before you sell short using this advanced TWS trading tool.

- Pre-Borrow Program – Pre-borrow shares to decrease the chances of being bought-in on settlement date.

- FYI Notifications –Sign up to be notified when a borrow becomes available in shares that you were unable to short in the last week.

Stock Yield Enhancement Program

Earn extra income on the fully-paid shares of stock held in your account by joining BMC's Stock Yield Enhancement Program . This plan allows BMC to borrow shares from you in exchange for cash collateral, and then lend the shares to traders who want to sell them short and are willing to pay interest to borrow them. Each day that your stock is on loan, you will be paid interest on the cash collateral posted to your account for the loan based on market rates.

who have been approved for a margin account, or who have a cash account with equity greater than 50,000 USD.

The program is available to eligible BMC clients 1 who have been approved for a margin account, or who have a cash account with equity greater than 50,000 USD.

Benefits

Simple and Automatic

BMC manages all aspects of share lending. Once you enroll, BMC will examine your fully-paid stock portfolio automatically. If you have stocks that are attractive in the securities lending market, BMC will borrow the stocks from you, deposit collateral into your account and lend the shares. It's that simple.

Complete Transparency

When your stock is loaned out, you will see the interest rate that you are being paid on the cash collateral along with the amounts earned by BMC from lending those shares. Other brokers with similar programs generally do not disclose the market rates to you, which allows them to pay you a small piece of the pie while holding on to most of the profits.

Earn Supplemental Income

Each day that your stock is on loan, BMC pays interest on the cash collateral directly into your account.

Trade Your Loaned Stock with No Restrictions

You will see the loaned shares on your account statement, indicating that they are being loaned out. You are still the owner of the stock, which means you continue to have market risk and will recognize any profit (or any loss) if the stock price moves. You can sell your shares at any time without any restriction. You can terminate your participation at any time for any reason.

Example:

XYZ is currently trading at $75.00/share. You're long 5000 shares of XYZ, with a market value of $375,000.00. XYZ is in demand and commands a loan interest rate of 9%.

You Could Earn $16,875.00/year on Stock You Already Own

You sign up for BMC's Stock Yield Enhancement Program, and BMC loans out your 5000 shares of XYZ at 9%. BMC will pay interest on your cash collateral of $375,000 x 4.5% = $16,875.00.

Eligibility

The Stock Yield Enhancement Program is available to eligible BMC clients 1 who have been approved for a margin account, or who have a cash account with equity greater than 50,000 USD.

Stocks that are eligible to be loaned out are all "fully-paid" stocks (stocks not held on margin) and "excess-margin" stocks (stocks held on margin but whose market value exceeds 140% of your margin debit balance).

Considerations and Risks

-

Shares loaned out may not be protected by SIPC

The Securities Investor Protection Act of 1970 may not protect shares loaned out. This is why under SEC rules BMC must provide you with cash collateral in the same amount as the value of your shares to protect you in the very unlikely event that the stock is not returned to you. -

Shares loaned out are typically used to facilitate short sales

Shares are attractive in the stock loan market because other traders want to borrow and sell them short, possibly affecting the value of the shares. -

Potential adverse tax consequences from receiving cash Payments in Lieu of Dividends on loaned shares for US taxpayers

When you lend stocks, you receive the full equivalent of all dividends. However, during the period of the loan any cash you receive "in lieu of" dividends is treated as ordinary income that is not eligible for the lower rates that apply to qualified dividends. BMC will try to return shares to you prior to a dividend to reduce or avoid any potential tax consequences.

- Loan rates (and the interest you will receive) change frequently and may go down (or up) by 50% or more

-

Loans may be terminated at any time by IB

Also, BMC does not guarantee that it will lend all eligible shares. -

Voting rights go to the borrower

During any period in which your securities are loaned out, you will forfeit your right to vote those shares by proxy. -

Selling your shares or borrowing against them or withdrawing cash in a margin account will terminate the loan transaction

If you sell the fully paid shares that have been lent out, or if you borrow the shares or withdraw cash in a margin account (such that the securities become margin securities and are no longer fully paid or excess margin securities) the loan will terminate and you will stop receiving loan interest.

For More Information

- For a complete discussion of the risks and characteristics of the program, click here .

- Sign up for BMC's Stock Yield Enhancement Program on the Trading Configuration or Trading Permissions page in Account Management.

- For more information, see our FAQ page

Tools

In addition to the Stock Yield Enhancement Program , we offer a variety of securities financing tools.

Short Stock Availability Tool

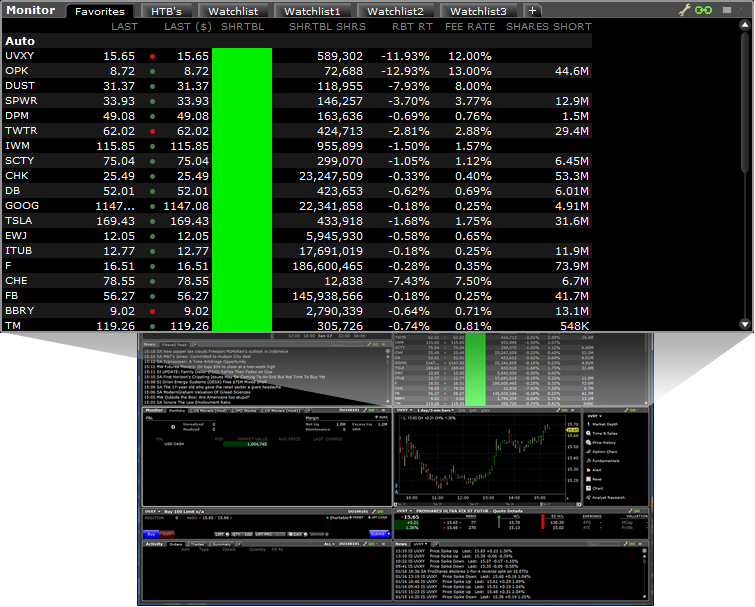

The Short Stock Availability Tool, part of Best Mastery Capital' Stock Borrow Loan system, is a fully electronic, self-service utility that lets you search for availability of shortable stocks. The data is updated periodically throughout the day.

The list of shortable stocks is indicative only and is subject to change. BMC does not accept short sale orders for US stocks that are not eligible for DTC continuous net settlement (CNS) and all short sale orders are subject to approval by IB.

The Short Stock Availability Tool, easily accessible from our Account Management system, lets you:

- View quantity available, number of lenders and current indicative borrow rate (the rate at which dealers in the Securities Lending/Borrowing Market are willing to transact today).

- View historical indicative borrow rates and download these rates in a comma-separated values (.csv) file, which you can open in Microsoft Excel.

- Search for any shortable stock by symbol and exchange, ISIN or CUSIP number.

- Upload a bulk request text file to search for availability of multiple shortable stocks at once.

- Download prepared lists of shortable stocks grouped by country.

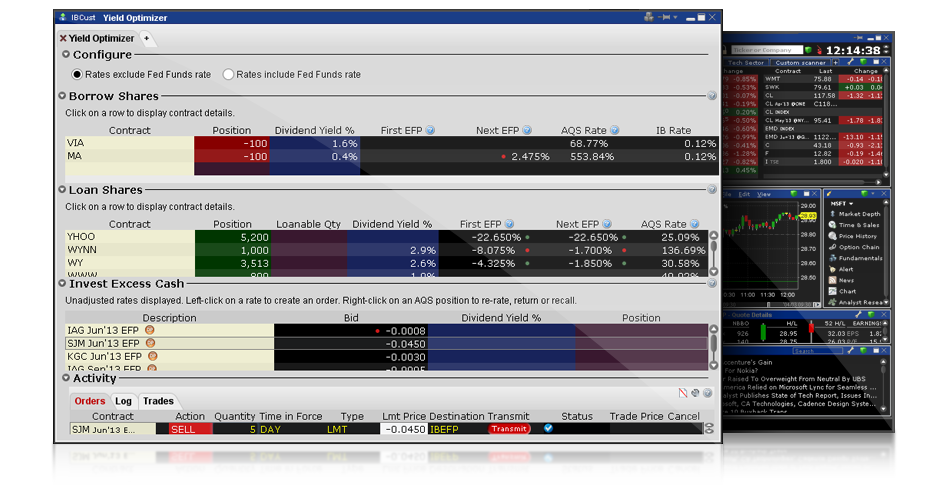

Yield Optimizer

The Yield Optimizer, included with Trader Workstation, lets you compare securities financing rates across the current SLB market, and One Chicago's single stock futures market. Use different borrow strategies, view the best rates for lending your own shares and see the most cost-effective EFPs for investing your excess cash.

For more information, see our Yield Optimizer page.

Pre-Borrow Program

Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Once you have joined the Pre-Borrow Program, you can pre-borrow stocks in anticipation of a short sale using the Stock Borrow/Loan feature in TWS. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles.

Availability List

The list of shortable stocks is indicative only and is subject to change. BMC does not accept short sale orders for US stocks that are not eligible for DTC continuous net settlement (CNS) and all short sale orders are subject to approval by IB."

|

Americas

|

|

|---|---|

| Country | Shortable Stocks |

United States |

Shortable: 12934 Listed for Trading: 15564 |

Canada |

Shortable: 1357 Listed for Trading: 3923 |

Mexico |

Shortable: 111 Listed for Trading: 1037 |

Click Here for most recent updates, if available.

|

Europe

|

|

|---|---|

| Country | Shortable Stocks |

Germany |

Shortable: 1249 Listed for Trading: 3221 |

United Kingdom |

Shortable: 2947 Listed for Trading: 6773 |

France |

Shortable: 453 Listed for Trading: 1392 |

Netherlands |

Shortable: 216 Listed for Trading: 384 |

Switzerland |

Shortable: 936 Listed for Trading: 1826 |

Belgium |

Shortable: 56 Listed for Trading: 164 |

Sweden |

Shortable: 142 Listed for Trading: 788 |

Spain |

Shortable: 78 Listed for Trading: 220 |

Austria |

Shortable: 36 Listed for Trading: 92 |

Italy |

Shortable: 556 Listed for Trading: 1320 |

Click Here for most recent updates, if available.

|

Asia

|

|

|---|---|

| Country | Shortable Stocks |

Australia |

None available at this time |

Japan |

Shortable: 2294 Listed for Trading: 3867 |

Hong Kong |

Shortable: 505 Listed for Trading: 4001 |

India |

None available at this time |

Click Here for most recent updates, if available.

The Availability List for bonds is indicative only and is subject to change. All short sale orders are subject to approval by IB.

|

Americas

|

|

|---|---|

| Country | Shortable Bonds |

United States |

Shortable: 13622 Listed for Trading: 220980 |

Canada |

None available at this time |

Mexico |

None available at this time |

Click Here for most recent updates, if available.

|

Europe

|

|

|---|---|

| Country | Shortable Bonds |

Germany |

None available at this time |

United Kingdom |

None available at this time |

France |

None available at this time |

Netherlands |

None available at this time |

Switzerland |

None available at this time |

Belgium |

None available at this time |

Sweden |

None available at this time |

Spain |

None available at this time |

Austria |

None available at this time |

Italy |

None available at this time |

Click Here for most recent updates, if available.

|

Asia

|

|

|---|---|

| Country | Shortable Bonds |

Australia |

None available at this time |

Japan |

None available at this time |

Hong Kong |

None available at this time |

India |

None available at this time |

Click Here for most recent updates, if available.

BMC clients who only execute through IB, but do not use BMC as their clearing broker or custody agent ("Non-Clearing Customer"), may click here 点击此处 for a list of valid Market Participant Identifier (MPID) codes to be entered with their short sale orders.

Disclosures

- Not all clients are eligible to participate in the Stock Yield Enhancement Program. Currently, clients of BMC India and BMC Japan are NOT eligible. Clients of BMC LLC, BMC Canada and BMC UK are eligible, as are Japanese and Indian clients who trade with BMC LLC.

We do not allow short-sale orders for less than 1 round lot (100 shares in US/Canada).